How Loan Size Impacts Refinancing in St. Louis | Carlson Mortgage

If you’re considering refinancing your existing mortgage or exploring home loan options for a new purchase in St. Louis, you may be wondering whether now is the right time. As mortgage rates in 2025 show some signs of potential improvement, uncertainty about inflation and economic policy continues to loom. At Carlson Mortgage, we specialize in helping homeowners and buyers navigate these decisions. With over 20 years of experience as a mortgage loan officer, I’ve seen how nuanced these choices can be.

We pride ourselves on offering some of the lowest interest rates in Missouri and charging no broker fees, making your journey to better financial options smoother and more affordable.

Should You Refinance Your Mortgage?

Deciding whether to refinance can feel overwhelming, especially with fluctuating market conditions. Unfortunately, there’s no universal rule of thumb that applies to everyone. Each homeowner’s situation is unique, with factors such as loan balance, interest rates, and financial goals playing critical roles.

However, we can provide valuable insights to help you determine whether refinancing makes sense for you. Our focus here is on rate-and-term refinancing, which replaces your existing loan with a new one at a lower interest rate and/or different term. These types of refinances are particularly appealing when rates are favorable.

Cash-out refinances, on the other hand, are less attractive right now due to current rate levels.

Loan Balance: A Key Factor in Refinancing Decisions

One of the most important aspects to consider when refinancing is the size of your outstanding loan balance. Larger loan amounts often make refinancing more advantageous, as the potential savings are more significant.

How Loan Size Impacts Savings

The latest Mortgage Monitor report highlights how loan size affects refinancing decisions. Homeowners with smaller loan balances—those under $250,000—generally require a rate reduction of at least 1.25% (125 basis points) to justify refinancing. For example, a borrower with a 7.75% interest rate would need to see it drop to at least 6.5% to make refinancing worthwhile.

On the other hand, borrowers with loan balances of $750,000 or more often act on smaller rate reductions. Around 40% of these borrowers refinanced with rate decreases of just 0.75% (75 basis points) or less. In some cases, refinancing for a reduction as small as 0.5% proved worthwhile.

This discrepancy comes down to simple math—larger loans yield more substantial monthly savings, even with smaller rate reductions.

Real-World Examples of Refinancing Savings

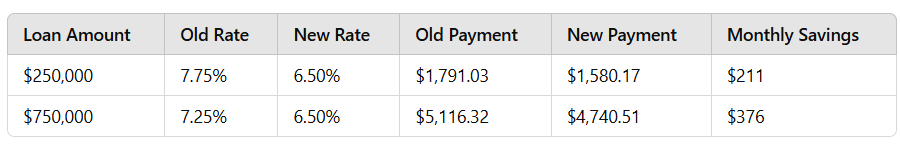

Let’s look at two hypothetical scenarios to illustrate how loan size impacts savings:

For the $250,000 loan, a 1.25% rate reduction results in monthly savings of $211. Meanwhile, the $750,000 loan only required a 0.75% rate reduction to generate $376 in monthly savings.

These examples show why borrowers with larger loans may find refinancing appealing even with smaller rate reductions. Conversely, homeowners with smaller loans often need more significant rate drops to justify refinancing.

Do the Math Before Refinancing

At Carlson Mortgage, we encourage you to take the time to calculate your potential savings. While refinancing can lead to significant benefits, it’s essential to weigh the costs—such as closing fees—against your expected savings.

By doing the math, you’ll gain clarity on whether refinancing aligns with your financial goals. Remember, there’s no one-size-fits-all answer, but a well-informed decision can yield incredible returns.

Why Choose Carlson Mortgage?

As a trusted mortgage broker in St. Louis, Carlson Mortgage is here to guide you every step of the way. Our extensive experience, commitment to transparency, and competitive rates make us the go-to choice for refinancing and home loan services in Missouri.

If you’re ready to explore your refinancing or purchase loan options, contact us today. Let’s see how we can help you save money and achieve your financial goals.

Ready to Secure Your Dream Home in St. Louis?

At Carlson Mortgage, we’re dedicated to helping St. Louis residents navigate the mortgage process and find the perfect loan for their needs. Our experienced mortgage brokers can help you find the perfect loan to fit your needs and budget and will help you make informed decisions about buying a home. Call or text us at (314) 329-7314 or fill out our loan application at www.carlsonstl.com/apply for a purchase or a refinance mortgage, or if you have any general mortgage lending questions.

Comments are closed