Mortgage Rate History and What It Means for St. Louis Homebuyers

If you’re planning to buy a home in St. Louis, Missouri, understanding how mortgage rates have changed over time can help you make informed financial decisions. As a top-rated St. Louis mortgage broker with over 20 years of experience, Carlson Mortgage is committed to helping homebuyers get the best possible rates with no broker or processing fees. Let’s take a journey through mortgage rate history to understand today’s market and how you can benefit.

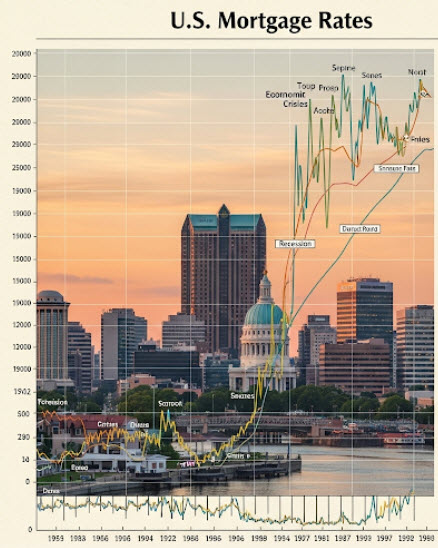

A Look Back: Mortgage Rates from the 1900s to Today

In the early 1900s, mortgage loans were quite different from what we’re used to today. Home loans often required a 50% down payment, had very short terms (around 5 years), and were interest-only. These were known as “balloon mortgages” because the entire loan balance would come due at the end of the term. Refinancing was often necessary, making homeownership less stable and less accessible.

Things changed dramatically during the Great Depression. The federal government stepped in with the National Housing Act of 1934, which created the Federal Housing Administration (FHA). This was a game-changer: long-term, fixed-rate mortgages with lower down payments became the new standard, allowing more Americans to afford homes. By the 1950s, the 30-year fixed mortgage had become the industry norm.

The 1980s: A Lesson in Volatility

Fast forward to the late 1970s and early 1980s—a period marked by high inflation and economic uncertainty. Mortgage rates soared to historic highs, reaching over 18% in 1981. For homebuyers, this made monthly mortgage payments skyrocket, significantly impacting affordability. It was a tough time to purchase a home, and many Americans were priced out of the market.

The Downward Trend: Rates Start to Fall

After peaking in the early ’80s, mortgage rates began a slow but steady decline. Thanks to more stable monetary policy and declining inflation, rates dropped throughout the 1990s and 2000s. The 2008 financial crisis brought another sharp drop, with the Federal Reserve implementing policies to keep rates low and stimulate the economy.

2020-2021: Historically Low Rates

In response to the COVID-19 pandemic, the Fed again reduced interest rates. This brought mortgage rates to historic lows, with some 30-year fixed rates dipping below 3% in 2020 and 2021. This created a surge in home purchases and refinances, as buyers jumped at the opportunity to lock in low monthly payments.

2022 and Beyond: A Shifting Market

As inflation concerns rose again, rates began to tick back up in 2022. While still low compared to the highs of the 1980s, these increases served as a reminder of the dynamic nature of the mortgage market.

What This Means for St. Louis Homebuyers

If you’re in the market to buy a home in St. Louis, understanding this rate history can help you better appreciate today’s options. At Carlson Mortgage, we work with multiple lenders to find you the lowest available rates in Missouri. Plus, we don’t charge broker fees, processing fees, or points, helping you save thousands over the life of your loan.

Whether you’re a first-time buyer, looking to refinance, or ready to move into a larger home, our personalized mortgage solutions are designed to meet your financial goals. With over 20 years in the mortgage industry and 15 years running Carlson Mortgage, our expertise can help you navigate the complexities of home financing.

Contact Carlson Mortgage

Ready to get started on your St. Louis home purchase? Reach out to us today:

- Call: 314-329-7314

- Email: info@carlsonstl.com

Let us help you secure the best mortgage rate so you can move into your new home with confidence and peace of mind.

Ready to Secure Your Dream Home in St. Louis?

At Carlson Mortgage, we’re dedicated to helping St. Louis residents navigate the mortgage process and find the perfect loan for their needs. Our experienced mortgage brokers can help you find the perfect loan to fit your needs and budget and will help you make informed decisions about buying a home. Call or text us at (314) 329-7314 or fill out our loan application at www.carlsonstl.com/apply for a purchase or a refinance mortgage, or if you have any general mortgage lending questions.

Comments are closed