Unlocking Opportunities: How Higher Mortgage Rates Benefit St. Louis Homebuyers

Making the Most of Rising Mortgage Rates

It’s no secret that high mortgage rates can be a source of concern for those in the market for a new home. They can pose challenges for prospective homebuyers, especially when property prices are on the rise. Additionally, these high rates have resulted in job losses within the mortgage industry and related sectors. While it’s true that investors may earn more interest on loans with higher mortgage rates, there’s a catch – these loans are often paid off more quickly, which can make them less appealing. However, amidst these stubbornly high rates, there’s a silver lining that St. Louis homebuyers might want to consider.

Anticipating a Mortgage Refinance Boom

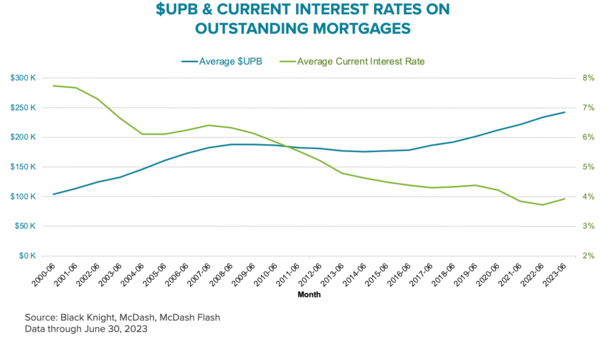

The longer mortgage rates remain elevated, the more high-rate home loans we’ll see. It’s a straightforward concept – as long as lenders continue to issue new loans, high interest rates will persist. The above chart from Black Knight highlights that the average interest rate on existing mortgages is around 3.94%, and it’s gradually increasing over time. As more high-rate mortgages are being originated, this average rate is expected to rise, replenishing the refinance pool, which has been relatively dry.

As of our last check, the popular 30-year fixed mortgage rate in St. Louis, Missouri has reached over 7.5%, a significant jump from the 2-3% range in 2021 and early 2022. While we hope not to reach the extremes of the past, the current rates have led to a notable drop in home loan activity. Mortgage refinances have become scarce, and home purchases have also dwindled due to affordability concerns. This is true for both St. Louis City and St. Louis County and for St. Charles/St. Peters. The industry is grappling with a scenario where mortgage rates have more than doubled in a very short span, which is taking a toll on various professionals, including loan officers, mortgage brokers, real estate agents, and title and escrow officers.

Despite this significant increase in mortgage rates, there is still a substantial amount of business in the greater St. Louis area taking place. Nationwide, mortgage lenders are expected to close nearly $2 trillion in home loans this year, according to forecasts from the Mortgage Bankers Association. While this falls short of the record-breaking year in 2021 when lenders originated around $4.4 trillion in home loans, it’s a significant figure given the sudden surge in mortgage rates.

Adjusting to Changing Times

The industry had been flourishing just before this unprecedented mortgage rate spike. Lenders, real estate agencies, escrow and title companies, and other related businesses were fully staffed. However, the rapid decline in business volume necessitated major staffing adjustments. Many St. Louis mortgage professionals have had to leave the industry, but, as history has shown, opportunities arise, especially when there are fewer players left.

Mortgage rates are bound to come down at some point, presenting trillions of dollars in home loans ripe for refinancing once again. While the timing remains uncertain, it’s a fact that it will happen.

Potential Relief for Homeowners

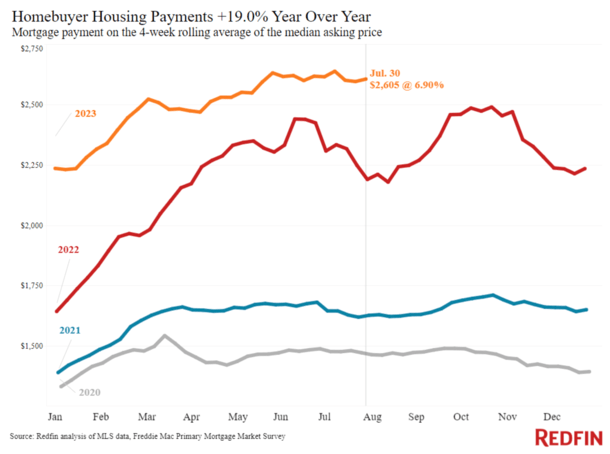

Amidst these challenging times, recent homebuyers are also feeling the strain of high mortgage rates. A few years ago, the 30-year fixed-rate mortgage was a fantastic deal, but it has become a burden for homeowners. Despite affordability concerns, home prices in St. Louis and elsewhere have remained near record highs due to supply shortages, pushing up the typical monthly payment for homebuyers.

Real estate agents and loan officers have been emphasizing the importance of “date the rate, marry the house” – meaning that while interest rates are temporary, homeownership is a long-term investment. When interest rates eventually come down, those St. Louis homeowners currently locked into higher rates will have the opportunity to refinance at more favorable terms.

As time goes on, interest rates are likely to decrease, providing relief to homeowners who initially secured mortgages in the 7%-8% range. With each passing day, as more of these mortgages are funded, more opportunities are created for those looking to take advantage of lower rates in the future.

Posted by: Carlson Mortgage – a top-rated St. Louis mortgage broker providing home loans in the state of Missouri. We are routinely ranked as a #1 mortgage broker in Missouri on Yelp, Google and Zillow. We can be reached at (314) 329-7314 seven days a week.

Our loan application can be found here or you can call us at 314-329-7314 to speak with one of our mortgage loan officers. Also, here is our pre-approval page, if you are looking to buy a home or need a referral to a top real estate agent.

Let us be your source for some of the lowest mortgage interest rates in St. Louis on first-time home buyer, conventional, FHA, Veterans (VA), Jumbo and condominium (condo) financing. Since 2004, we’ve been providing home loans and mortgage services in St. Louis that are tailored individually to your unique needs and to your financial situation. Call us today to inquire about home loan interest rates, to get pre-approved for a purchase or a refinance mortgage, or if you have any general mortgage lending questions.

Comments are closed